Understanding Shoe Cover HSN Codes: IT & Q with Global Application

expertise HSN codes is vital for product categorization and control, mainly for objects like shoe covers. the subsequent will offer an in depth creation to the unique utility of HSN codes in shoe cover merchandise, assisting readers master the method of querying and updating them to ensure accuracy and compliance in categorization.

Shoe Cover HSN Code Overview

The Harmonized machine wide variety (HSN), an the world over identified commodity coding gadget hooked up by way of the world Customs corporation, performs a crucial function within the classification and coding of goods in international exchange. in the category of shoe covers, the HSN code is of enormous significance, because it no longer simplest enables the type and management of products however additionally simplifies customs clearance processes in international exchange.

The HSN code for shoe covers often objectives various products used to defend shoes, including but now not confined to rain shoe covers, protecting shoe covers, and thermal shoe covers. these merchandise are extensively utilized in industries, agriculture, and each day lifestyles, and play a critical role in improving working environment comfort and safeguarding human health.

in keeping with the HSN coding machine, shoe cowl products are usually categorized beneath chapter sixty five “footwear, Leggings, and similar Articles, and Their components.” inside this bankruptcy, the particular HSN code for shoe covers is 6609. This code in addition subdivides into differing types and makes use of of shoe covers, consisting of:

- 6609.10: waterproof shoe covers for rain boots or similar shoes

- 6609.20: shielding shoe covers to defend footwear from chemical substances, oil stains, and different contaminants

- 6609.30: Thermal shoe covers for iciness warm temperature

those subcodes assist importers, exporters, and customs officers correctly identify and classify shoe cover products, making sure the accuracy and consistency of change data.

In sensible packages, the use of the shoe cowl HSN code aids inside the following components:

- Product class: via HSN codes, shoe cover merchandise may be prominent from different footwear items, facilitating market evaluation and stock control.

- Tax Calculation: HSN codes are an vital foundation for calculating import price lists and home taxes, making sure correct tax collection.three. exchange statistics: The application of HSN codes facilitates customs and exchange information companies in special international locations accumulate and examine trade records, offering a basis for coverage formulation.four. Clearance performance: correct product coding can boost up customs clearance, reducing pointless inspections and delays.

With the improvement of international alternate, the upkeep and replace of HSN codes are also ongoing obligations. For shoe cover HSN codes, applicable businesses will adjust the codes as needed primarily based on market changes and product updates to make certain their applicability and accuracy. therefore, it’s far important for organizations engaged in the production and trade of shoe covers to maintain abreast of the dynamic updates of HSN codes.

HSN Code Application in the Field of Shoe Covers

The Harmonized System Number (HSN) code, widely used in international trade, plays a significant role in the application of shoe cover products in the following aspects:

-

Product Classification and IdentificationHSN codes provide a unified classification standard for shoe cover products, enabling merchants, customs, logistics, and other relevant departments in different countries and regions to quickly and accurately identify and classify shoe cover products. This helps simplify trade processes and improve efficiency.

-

Tax ManagementIn import and export trade, governments around the world levy corresponding tariffs on goods based on HSN codes. Through HSN codes, shoe cover products can clearly define their tax categories, facilitating tax administration for tax authorities. At the same time, HSN codes also facilitate cost accounting and tax declarations for enterprises.

-

Statistics and AnalysisHSN codes assist in collecting and analyzing market data for shoe cover products. By statistically analyzing sales volume, prices, and other information under different HSN codes, enterprises can understand market demand, adjust production strategies, and governments can also formulate relevant policies through these data.

-

Trade FacilitationAs a universal language in international trade, HSN codes help reduce trade barriers and promote global shoe cover product trade. Enterprises can conduct procurement, sales, and logistics activities globally with the help of HSN codes, enhancing international competitiveness.

-

Quality RegulationDuring the production process of shoe cover products, HSN codes help regulatory authorities monitor product quality. Through HSN codes, it is possible to trace the production and distribution process of products to ensure that quality meets national standards.

-

Supply Chain ManagementHSN codes play a crucial role in supply chain management. Enterprises can effectively manage raw materials, semi-finished products, and finished products through HSN codes, improving inventory turnover rates and reducing logistics costs.

-

Marketing and PromotionHSN codes help enterprises in market marketing and promotion activities by precisely positioning their products. Through HSN codes, consumers can quickly understand the characteristics and uses of products, thereby increasing purchase intention.

-

Cross-Border E-commerceWith the rapid development of cross-border e-commerce, the application of HSN codes in shoe cover products becomes increasingly important. Enterprises can quickly release product information on cross-border e-commerce platforms through HSN codes, attracting more consumers.

The application of HSN codes in shoe cover products is multifaceted. It not only helps improve trade efficiency and reduce costs but also plays a positive role in areas such as quality regulation and marketing. As international trade continues to develop, the application of HSN codes in shoe cover products will become even more widespread.

Certainly, here is the translation:”Please provide the specific HSN code for shoe covers and I will explain the specific coding breakdown.”

The Harmonized System of Nomenclature (HSN) is a universally accepted commodity classification coding system used in international trade. Its application in shoe cover products is evident in the precise classification of various types of shoe covers, facilitating statistics, management, and import/export declarations among other processes. Below is a detailed explanation of the HSN codes for shoe covers:

-

The HSN code for shoe covers typically originates from Category 12, “Footwear, leg guards and similar articles, and their parts.”

-

Within Category 12, the coding for shoe covers is usually found under Subcategory 12.06, which specifically targets “Sets or covers for footwear.”

-

Depending on the type and purpose of the shoe covers, the HSN codes can vary. For instance:

- 12.06.10: Sets or covers for protecting footwear, such as waterproof shoe covers.

- 12.06.20: Shoe covers for special occasions or operations, such as oil-resistant shoe covers, static-dissipative shoe covers.

- 12.06.30: Shoe covers for sports or leisure, such as sports shoe covers, leisure shoe covers.

- Further refinement within Subcategory 12.06 can be achieved by adding digits to the code. For example, the coding under 12.06.10 may include:

- 12.06.10.10: Waterproof shoe covers for outdoor activities.

- 12.06.10.20: Cold weather waterproof shoe covers, suitable for low-temperature environments.

-

For the parts of shoe covers, such as straps and buckles, their HSN codes are usually located in Category 42, “Leather goods; artificial leather goods; other goods.”

-

Within Category 42, the coding for shoe cover parts may be found under Subcategory 42.01, such as:

- 42.01.10: Shoe cover straps, used for securing the shoe cover.

- 42.01.20: Shoe cover buckles, used for connecting different parts of the shoe cover.

Through this coding explanation, it can be seen that the application of HSN codes in shoe cover products not only aids in classification but also simplifies processes in import/export trade, enhancing efficiency. Proper use of HSN codes helps businesses accurately declare their goods, avoiding losses or trade disputes due to incorrect coding. Moreover, for customs and trade regulatory authorities, HSN codes are essential tools for conducting commodity statistics and regulation.

Please pay attention to the following usage tips for shoe cover HSN codes.

When using HSN codes for shoe covers, the following should be taken into account:

-

Accurate Product Classification: Ensure the correct identification of the specific category to which shoe covers belong, as HSN codes are classified based on product characteristics. Incorrect classification may lead to improper use of the code.

-

Comply with the Latest Version: HSN codes are updated with the development of international trade and domestic markets. Before use, confirm that the HSN code you are using is the latest version to avoid issues caused by outdated codes.

-

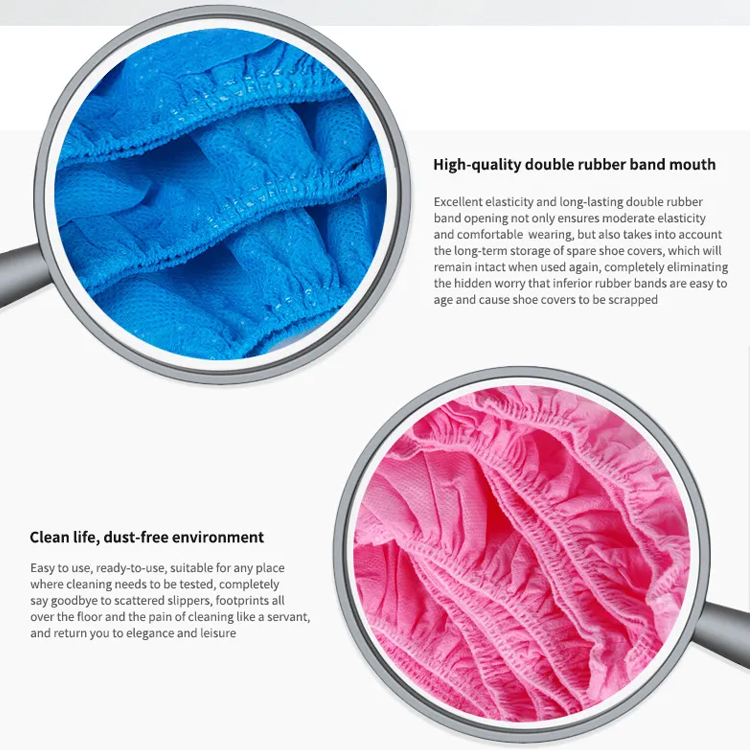

Distinguish Different Materials: Shoe covers can be made from various materials such as plastic, rubber, fabric, etc. Different materials correspond to different HSN codes, and the correct coding must be selected based on the actual material.

-

Pay Attention to Size Specifications: Some HSN codes are specific to shoe covers of certain sizes. When using the code, ensure that the product size meets the coding requirements to avoid confusion.

-

Avoid Code Confusion: Some shoe covers may fit the description of multiple HSN codes, but each product can only correspond to one HSN code. Careful judgment is required to avoid confusion when using the code.

-

Consider Packaging and Usage: The packaging and usage of shoe covers may also affect the choice of HSN code. For example, disposable shoe covers and reusable shoe covers may belong to different HSN codes.

-

Check Product Descriptions: When using HSN codes, the product description should match the product features corresponding to the HSN code to avoid coding errors due to inaccurate descriptions.

-

Understand Tax Policies: Tax policies in different countries and regions may have specific requirements for the use of HSN codes. When using HSN codes for tax declarations, it is necessary to understand and comply with relevant tax regulations.

-

Record Code Usage: Keep a record of the HSN codes used for auditing and reference purposes, ensuring the compliance of coding usage.

-

Train Personnel: Ensure that all personnel involved in the use of HSN codes are familiar with the rules and to reduce coding misuse due to human error.

-

Consult Experts: In cases of complexity or uncertainty, it is advisable to consult tax experts or industry consultants to ensure the correct use of HSN codes.

By following these, you can effectively avoid errors when using HSN codes for shoe covers, ensuring the accuracy of trade and tax processing.

Shoe Cover HSN Code Inquiry and Update Process

- query Steps

- visit the respectable internet site of the countrywide Tax administration or related e-commerce structures.

- input “HSN code” or “product code” in the seek box to retrieve records.

- choose “shoe covers” as the seek keyword, and the machine will display a listing of associated HSN codes.

- selecting the proper HSN Code

- pick the corresponding HSN code primarily based on the unique type and material of the shoe covers. for instance, if it is a water-proof shoe cowl, the corresponding HSN code can be “3926”.

- Pay interest to distinguish between HSN codes for exceptional types of shoe covers, which includes regular shoe covers and business shoe covers, to keep away from the usage of the incorrect code.

three. Verifying the HSN Code- After locating the HSN code for shoe covers in the search results, verify it.- you can verify the validity of the HSN code via contacting the provider or at once checking it inside the national Tax administration’s query gadget.

four. Updating procedure- replace the manner when there are adjustments in product categories or HSN codes.- Log in to the country wide Tax administration’s authentic website via the agency tax registration account.- enter the “announcement management” or “Product Code management” module, pick out “replace HSN Code”, and fill within the replace information, then put up the alternate application.

- record Saving and Archiving

- store all operation steps and associated documents at some point of the replace manner.

- Print out the up to date HSN code and report it inside the organization’s monetary or procurement records.

- internal Notification and education

- Notify relevant departments, along with procurement, income, and finance, after updating the HSN code.

- teach relevant personnel on the usage of the new code to make sure that every one personnel recognize the brand new coding.

- Adhering to Tax policies

- ensure compliance with country wide tax guidelines when using HSN codes to ensure the accuracy of tax declarations.

- consult the tax authority or a professional tax consultant if any troubles get up with the use of HSN codes.

- normal review

- regularly overview the use of HSN codes to make sure they’re regular with actual product classes.

- correct and replace any mistakes or omissions found.

- pass-Border trade issues

- Pay unique interest to the global uniformity of HSN codes for shoe covers worried in move-border trade.

- question the corresponding HSN code inside the international marketplace and make certain its validity in one-of-a-kind countries’ tax structures.

- comments and development

- right away offer remarks to relevant departments on any problems encountered in the course of the usage of HSN codes.

- constantly improve the use technique and management gadget of HSN codes based on remarks.